From Hype to Practical Application

The buzz surrounding AI in real estate is well-founded, with projections indicating that AI-driven tools could reduce property valuation times by up to 90% and enhance accuracy through bias-free analysis. For our niche of lands, AI excels in several key areas, synthesizing complex data to deliver insights that go beyond what traditional methods offer.

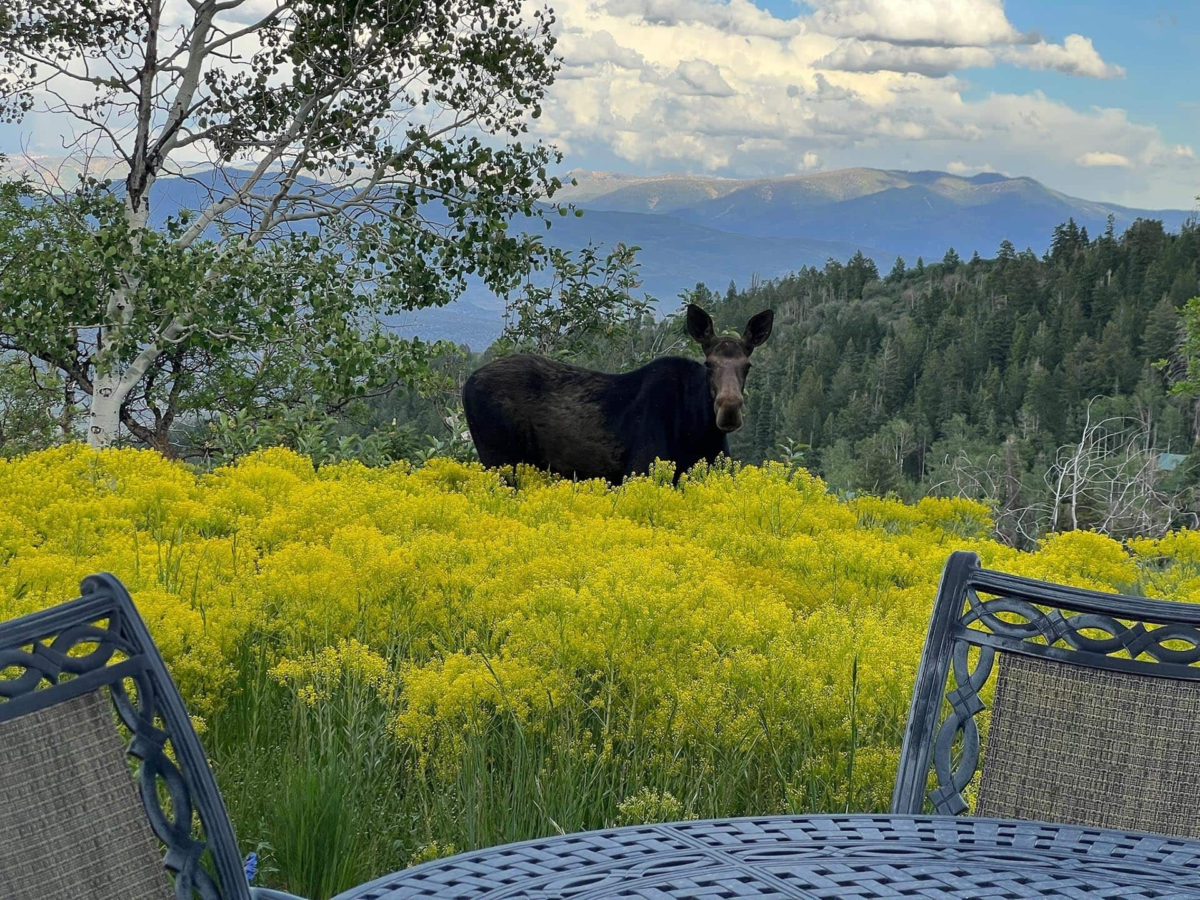

First, AI-powered valuation models can analyze historical sales, comparable properties, government soil data, and economic indicators. These systems incorporate geospatial data, such as satellite imagery for assessing land topography and vegetation indices, to evaluate agricultural productivity or recreational appeal. For instance, AI could potentially detect soil composition variations or drainage patterns that impact grazing potential, providing a more nuanced appraisal than manual surveys. However, partnering with a niche specialist ensures these insights align with local market realities.

Second, AI facilitates the identification of opportunities and landowner details. By processing public records, tax data, and ownership histories, AI tools can pinpoint motivated sellers, such as those with long-term holdings, out-of-state owners, or delinquencies, streamlining acquisition strategies. In recreational properties, AI might analyze wildlife migration patterns via integrated sensor data or trail camera feeds to quantify hunting or ecotourism value, adding a layer of insight for investors, who can then consult experts to validate and refine these findings.

Third, AI's research capabilities are vast. Generational owners might simplify daunting tasks their family hasn't had to consider, such as comprehensive summaries with the latest tax implications, inheritance laws, deduction strategies, or legal entity advice to help them accomplish their goals. AI applications will help discover, draft, and distill thoughts across multiple professions into cohesive objectives to discuss with advisors.

Moreover, AI's ability to draw conclusions from disparate data sources, such as combining zoning laws with market forecasts, enables predictive modeling. For example, it can simulate how infrastructure developments or environmental regulations might affect property values over time, helping buyers and sellers anticipate shifts—ideally in collaboration with a broker experienced in these specialized properties to ground predictions in a practical context.

In practice, these tools democratize access to sophisticated analysis, allowing even small-scale investors to compete with larger entities. However, the true value lies in AI's synthesis: not just aggregating data, but interpreting it to reveal opportunities, like identifying undervalued recreational land with untapped ecotourism potential based on social media sentiment and location data. Working with a professional in this niche ensures these revelations translate into viable strategies.